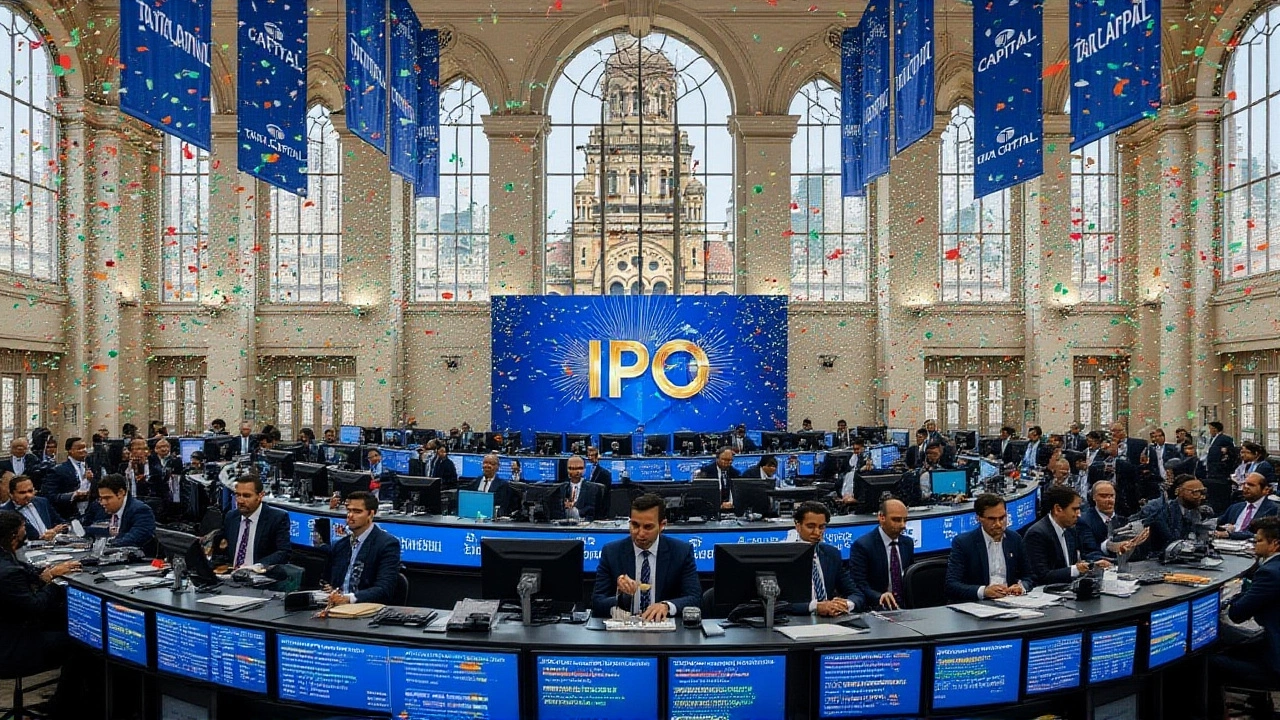

When Tata Capital announced its three‑day public offering on , the market sat up and took notice. The non‑banking financial company, a subsidiary of Tata Sons Private Limited, managed to draw full subscription across every investor tier by the close of business on , racking up Rs 15,512 crore (about $1.7 billion) in fresh capital.

Why the Tata Capital IPO mattered

India’s capital markets have been starved for a megadeal after a series of smaller listings in early 2025. The Tata brand, backed by a legacy that stretches back to 1868, brings a level of trust that few domestic NBFCs can match. By bolstering its Tier‑I capital, the company aims to satisfy Reserve Bank of India (RBI) prudential norms and fund an aggressive expansion of retail and wholesale lending across the country’s 1.4 billion‑strong population.

Chronology of the offering

The book‑building window opened on Monday, , with a price band set between Rs 310 and Rs 326 per share. Within the first hour, bids covered 15 % of the target size, signaling strong appetite from Qualified Institutional Buyers (QIBs). Day two saw steady inflows from Non‑Institutional Investors (NIIs), while retail interest peaked late on day three, pushing the overall subscription to 100 % for each category.

Key figures and market reaction

- Issue size: Rs 15,512 crore ($1.7 bn)

- Price band: Rs 310‑Rs 326

- Subscription: 100 % (QIBs), 100 % (NIIs), 100 % (Retail)

- Grey‑market premium on final day: 2 %

- Allotment date:

Analyst Shruti Jain, a research analyst at Arihant Capital, noted, “At roughly four‑times FY25 book value, the pricing reflects near‑term optimism but leaves limited upside on listing day.” An unnamed market watcher echoed the sentiment, warning that a cooling grey‑market premium could dampen the opening‑day pop.

Stakeholder perspectives

From the issuer’s side, the clean slate—100 % fresh issue, no offer‑for‑sale component—means the entire proceeds will sit in the balance sheet. Tata Sons will retain a controlling stake, preserving strategic oversight while inviting a broader investor base.

Institutional investors, notably foreign sovereign wealth funds and domestic pension schemes, praised the robust capital adequacy that the fresh equity will provide. “We see Tata Capital as a pivotal conduit for financing the next wave of consumption‑driven growth in tier‑II and tier‑III cities,” said a senior portfolio manager at a European asset manager who asked to remain anonymous.

Retail participants, however, appeared more cautious. The post‑IPO GMP slipped to just 2 % on the final day—a stark contrast to the 6‑8 % premiums seen in earlier phases. This suggests that while the brand carries weight, individual investors are weighing the relatively modest upside against the broader market’s volatility.

Potential impact on India’s financial sector

Strengthening Tier‑I capital positions Tata Capital to chase higher loan‑to‑value ratios, particularly in unsecured consumer credit—a segment that has been expanding at double‑digit rates. The infusion also equips the firm to meet RBI’s upcoming Basel‑IV–style guidelines, which are expected to tighten capital buffers for NBFCs starting 2026.

Moreover, the successful IPO could rekindle interest in large‑scale listings from other conglomerates that have hesitated after the slowdown in 2024. Should the shares trade within the expected Rs 326‑Rs 330 window, it would signal that investors remain confident in the Tata brand’s ability to generate sustainable returns.

Looking ahead: listing and beyond

Shares are slated for allotment on , with listings expected on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) shortly thereafter. While exact dates remain pending, market participants anticipate a modest opening‑day rally, driven more by brand loyalty than speculative frenzy.

In the longer term, Tata Capital plans to channel the capital into expanding its digital lending platforms, deepening its wealth‑management franchise, and exploring strategic acquisitions in the insurance distribution space. If successful, the NBFC could move closer to the revenue scale of its larger peers, positioning itself as a one‑stop financial services hub for millions of Indians.

Key facts at a glance

Below is a quick reference for readers who want the headline numbers without sifting through the narrative:

- Tata Capital IPO size: Rs 15,512 crore.

- Issue price band: Rs 310‑Rs 326.

- Subscription: 100 % across QIB, NII, and Retail categories.

- Allotment date: .

- Intended use of funds: Strengthen Tier‑I capital and expand lending operations.

Frequently Asked Questions

How will the proceeds be used by Tata Capital?

The fresh equity will be plowed into Tata Capital’s Tier‑I capital, a regulatory buffer that lets the firm increase its loan book. Management has signaled intentions to boost digital‑lending channels, expand wealth‑management services, and possibly pursue strategic acquisitions in insurance distribution.

Why did the grey‑market premium fall to 2 % on the final day?

The premium cooled as the book‑building window closed and investors reassessed the modest upside relative to the issue price. Analysts note that the IPO was priced near the top of its band, leaving limited room for a large opening‑day jump.

What does full subscription across QIB, NII and Retail segments indicate?

It shows balanced demand from sophisticated institutional investors, mid‑size corporate buyers, and individual investors alike. Such breadth reduces the risk of post‑listing price volatility and underscores broad confidence in the Tata brand.

When will Tata Capital’s shares start trading?

Allotments are scheduled for . The company expects listings on the NSE and BSE shortly after, though exact dates will be confirmed by the exchanges once the allotment process is complete.

How does this IPO compare with other large listings in 2025?

At Rs 15,512 crore, it tops the calendar year’s issuance volume, dwarfing the next biggest offering by roughly 30 %. The sheer size underscores the Tata Group’s ability to mobilize capital despite a generally cautious market mood.